Auto insurance is a necessary expense for every driver, but navigating the complex world of policies, coverage, and premiums can be daunting. At Capitol Benefits, we understand the challenges that come with finding the perfect auto insurance plan. That’s why we’ve put together this comprehensive guide to help you understand the ins and outs of auto insurance, so you can make informed decisions and get the best coverage for your needs.

- Understanding the Basics of Auto Insurance

Auto insurance is a contract between you and the insurance company that protects you against financial loss in the event of an accident or theft. In exchange for your premium payments, the insurance company agrees to pay for specific types of losses as outlined in your policy.

There are several types of auto insurance coverage, including:

- Liability coverage: This covers the costs of injuries or property damage you cause to others in an accident.

- Collision coverage: This pays for damage to your car resulting from a collision with another vehicle or object.

- Comprehensive coverage: This covers damage to your car from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you’re in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Determining the Right Coverage for Your Needs

To find the best auto insurance policy for your needs, consider the following factors:

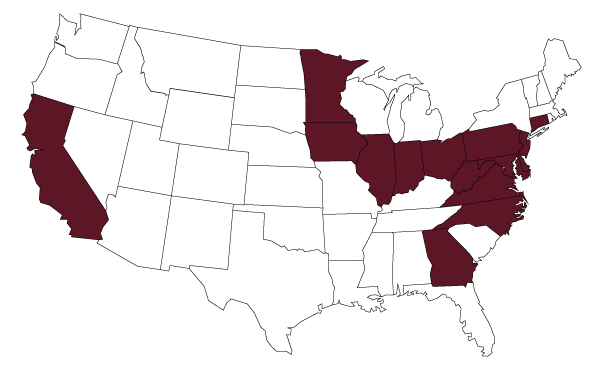

- State requirements: Each state has its own minimum insurance requirements, so make sure your policy meets those standards.

- Vehicle value: If you have a newer or more expensive car, you may want to consider higher levels of collision and comprehensive coverage.

- Personal assets: If you have substantial assets, you may want to choose higher liability limits to protect yourself in case of a lawsuit.

- Deductibles: A higher deductible can lower your premium, but you’ll have to pay more out-of-pocket in the event of a claim.

- Shopping for Auto Insurance

When shopping for auto insurance, it’s essential to compare quotes from multiple providers to ensure you’re getting the best deal. Keep in mind that the cheapest policy may not always be the best fit for your needs. Consider factors such as customer service, claim handling, and financial stability when choosing an insurance company.

- Discounts and Savings

Many insurance companies offer discounts to help you save on your auto insurance premiums. Some common discounts include:

- Safe driver discounts for maintaining a clean driving record

- Multi-policy discounts for bundling your auto insurance with other policies, such as home or renters insurance

- Good student discounts for maintaining good grades in school

- Vehicle safety discounts for cars with advanced safety features

- Filing a Claim

If you’re involved in an accident or need to file a claim, contact your insurance company as soon as possible. They’ll guide you through the process and help you get the necessary repairs or compensation. Keep in mind that filing a claim may result in an increase in your premium, depending on the circumstances.

In conclusion, navigating the complex world of auto insurance can be challenging, but it’s crucial to ensure you have the right coverage for your needs. By understanding the basics, determining the right coverage, shopping around, taking advantage of discounts, and knowing how to file a claim, you’ll be well-equipped to make informed decisions about your auto insurance. At Capitol Benefits, we’re here to help you every step of the way. Contact us today to discuss your auto insurance needs and let us find the perfect policy for you.