Why Manual Benefits Administration No Longer Works

If you’ve ever had three tabs open just to update one employee’s deduction—or chased a form across inboxes during open enrollment—you already know how chaotic benefits administration can be.

Manual processes drain time, create errors, and add unnecessary stress to HR’s most critical season. Between juggling vendors, fielding employee questions, and managing compliance, even small updates can snowball into hours of rework.

As HR teams gear up for open enrollment, this is the perfect time to ask: Is your system helping or holding you back?

That’s why more organizations are turning to modern HR technology like Rippling, a unified platform that centralizes payroll, benefits, compliance, and employee data in one place. Capitol Benefits recently partnered with Rippling to help clients streamline processes and reclaim valuable time during open enrollment and beyond.

The Evolution of HR and Benefits Admin Tools

During the webinar, Felicia Garry from Rippling shared how the HR tech landscape evolved—and why so many systems still leave HR leaders frustrated.

For years, employers have had three main options for managing people operations:

- Legacy Payroll Systems – Reliable but outdated. These tools (like ADP or Paychex) were built around payroll first, not benefits. They often require manual reconciliation and lack true integration with benefits carriers or 401(k) providers.

- Modern “Out-of-the-Box” Platforms – Sleek but rigid. Tools like Gusto or BambooHR are visually appealing and easy to set up but offer limited flexibility for organizations with more complex needs or multi-state employees.

- PEOs (Professional Employer Organizations) – Comprehensive but costly. PEOs handle payroll, benefits, and HR compliance under a shared tax ID. They can simplify operations but require employers to give up control and may restrict carrier choice (for example, many PEOs don’t work with CareFirst in the DMV area).

Each of these models solves some challenges—but introduces new ones. The result? HR departments still juggle siloed systems that don’t talk to each other.

Where Rippling Changes the Game

Rippling’s approach is different because it’s built on what Felicia calls the “employee graph.”

In simple terms, every piece of employee information—pay, position, benefits elections, and more—lives in one unified profile. Whenever HR updates that profile, the change automatically cascades through connected systems like payroll, time tracking, or benefits enrollment.

Here’s why that matters:

- No more double entry. Update once, and the change syncs everywhere.

- No more spreadsheet juggling. Employee data flows automatically to benefits carriers and payroll deductions.

- No more missed details. Every change—whether a promotion, new hire, or qualifying life event—is captured in real time.

This “single source of truth” eliminates countless manual steps, reduces costly errors, and gives HR teams full visibility into every part of the employee lifecycle.

From Chaos to Clarity: The Real Impact of Automation

Felicia shared that many employers still rely on paper enrollment or disconnected systems that make even simple changes complicated. When employees can’t easily compare plans or update their information, HR becomes the bottleneck.

With a centralized system like Rippling, both HR and employees get time back.

For HR teams:

- Automated enrollment workflows replace paper forms.

- Compliance is tracked automatically (eligibility, waiting periods, and contributions).

- Payroll deductions update instantly, without extra uploads or data imports.

- Open enrollment is simplified, with side-by-side plan comparisons built right in.

For employees:

- Intuitive dashboards show current and available benefits in one place.

- Changes for life events (like marriage or dependents) are seamless.

- They can view and compare plan options without decoding spreadsheets.

- Mobile access means they can review benefits anytime, anywhere.

“Manual enrollment isn’t just inefficient—it’s risky. One missed update can snowball into compliance issues or lost employee trust.”

The result? Faster onboarding, fewer errors, and less confusion—for everyone.

Quantifying the Time Savings

Automation doesn’t just make life easier—it has measurable ROI.

A Forrester study commissioned by Rippling found that mid-sized employers (26–150 employees) using the platform typically save the equivalent of two full-time HR roles worth of manual work per year.

That doesn’t mean layoffs—it means growth without adding overhead. As your company scales, Rippling allows you to handle more complexity without needing a bigger HR team.

Imagine onboarding a new hire in under 90 seconds or syncing benefits changes to payroll without touching a spreadsheet. Those small time savings add up quickly across the year.

A Partnership That Simplifies Everything

Capitol Benefits chose to partner with Rippling because it complements what we already do best: simplify benefits administration for employers.

Through this partnership, Capitol Benefits clients receive exclusive advantages, including:

- Free Benefits Administration setup – Implementation and plan builds are handled for you.

- Pre-negotiated rates – Access discounted pricing not available through direct channels.

- Dedicated support team – Work with Rippling’s most experienced account managers, who specialize in broker-referred clients.

- White-glove service – Capitol Benefits and Rippling collaborate directly, so you have one point of contact and seamless coordination between systems.

Because everything runs through your Capitol Benefits advisor, you still get unbiased recommendations on whether Rippling—or another solution—is the right fit for your business.

What the Demo Revealed

During the live demo, Felicia walked through how Rippling’s benefits module operates behind the scenes. Here’s what stood out:

- Simple Plan Setup & Enrollment

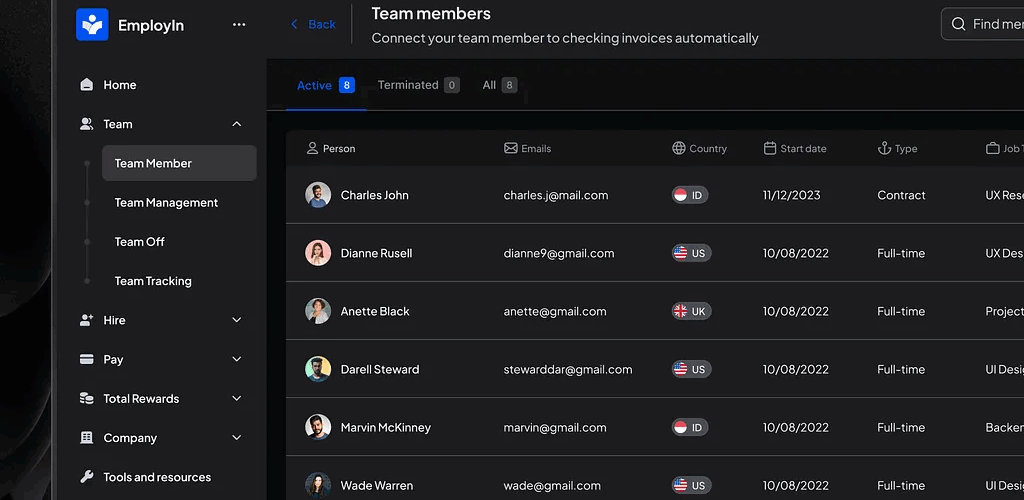

Rippling’s team builds and maintains your plan designs—no more manual uploads or carrier file transfers. HR can preview, edit, or download benefit packets instantly. - Intuitive Employee View

Employees see all benefits options in one dashboard. They can compare medical plans side-by-side, view premiums in real time, and even download summary PDFs before enrolling. - Automatic Payroll Integration

Any benefits selection immediately flows to payroll. Deductions and employer contributions are pre-calculated and error-free. - Seamless Compliance

Eligibility rules, waiting periods, and contribution tiers are all automated. The system tracks qualifying life events and ensures deadlines are met.

In short: what used to take hours now takes minutes—and the margin for human error drops dramatically.

Real-World Example

A Capitol Benefits client with around 80 employees recently transitioned from a legacy payroll system to Rippling. Before the switch, their HR coordinator spent nearly 10 hours a week reconciling payroll deductions and managing benefits changes manually.

After implementing Rippling, enrollment updates flowed automatically into payroll, and employees began self-serving most of their changes. Within two months, HR cut administrative time in half and reported zero benefits errors during their next open enrollment cycle.

Automation didn’t replace HR—it gave them time to focus on strategy, retention, and employee experience.

The Human Side of HR Tech

While the tech is impressive, what truly sets Rippling apart—and why Capitol Benefits recommends it—is the human experience.

The interface feels intuitive for employees. The automation feels empowering for HR. And the support model ensures you always have real people on the other side of the screen when questions arise.

Felicia put it best during the webinar:

“HR teams shouldn’t have to spend their days fixing spreadsheets. They should be helping people thrive.”

That’s exactly what smart systems enable.

Key Takeaway: Smarter Systems, Happier Teams

Manual processes aren’t just inefficient—they’re risky. Errors in payroll deductions or missed compliance steps can cost time, money, and trust.

By adopting a modern, connected system like Rippling, employers can:

- Automate repetitive tasks.

- Reduce errors and improve compliance.

- Empower employees with transparency and control.

- Free HR to focus on culture, engagement, and growth.

Want to see how Rippling could streamline your benefits administration? Watch the full webinar replay or request a benefits technology consultation with your Capitol Benefits advisor today.